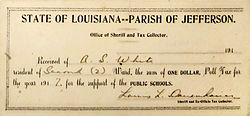

A poll tax is a tax of a fixed sum on every liable individual (typically every adult), without reference to income or resources. Although often associated with states of the former Confederate States of America, poll taxes were also in place in some northern and western states, including California, Connecticut, Maine, Massachusetts, Minnesota, New Hampshire, Ohio, Pennsylvania, Vermont, Rhode Island, and Wisconsin.[1] Poll taxes had been a major source of government funding among the colonies which formed the United States. Poll taxes made up from one-third to one-half of the tax revenue of colonial Massachusetts. Various privileges of citizenship, including voter registration or issuance of driving licenses and resident hunting and fishing licenses, were conditioned on payment of poll taxes to encourage the collection of this tax revenue. Property taxes assumed a larger share of tax revenues as land values rose when population increases encouraged settlement of the American West.[2] Some western states found no need for poll tax requirements; but poll taxes and payment incentives remained in eastern states. Poll taxes became a tool of disenfranchisement in the South during Jim Crow, following the end of Reconstruction. This persisted until court action, following the ratification of the 24th Amendment in 1964, ended the practice.

- ^ State of Maine Special Tax Commission (1890). Report of the Special Tax Commission of Maine. Maine: Burleigh & Flynt. pp. 39–41. OCLC 551368287.

- ^ Bullock, Charles J. (1916). "The Taxation of Property and Income in Massachusetts". The Quarterly Journal of Economics. 31 (1): 1–61. doi:10.2307/1885988. JSTOR 1885988.

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search